Category: Business

-

Global Email Encryption Market Is Expected To Reach Around USD 6.6 Billion By 2028

•

The growth in BEC scams and spear phishing, the growing number of email users worldwide, the high demand…

-

Global Expression Vectors Market Set for Moderate Growth to Reach USD around 330.3 Million by 2028

•

The rising need for protein-based treatments (biologics), the high frequency of lifestyle diseases, infectious diseases, and genetic disorders,…

-

Global End-of-line Packaging Market Set For Rapid Growth, To Reach Value Around USD 5.54 Billion By 2028

•

The global End-of-Line Packaging Market is being driven by the increasing usage of this type of packaging system…

-

Molded Pulp Packaging Market To Reach Around USD 5 Billion By 2025 With A CAGR Of 4.7%

•

The moulded pulp packaging market is expected to increase at a CAGR of 4.4 percent from 2019 to…

-

Global Meat Processing Equipment Market To Witness Impressive Growth, Revenue To Surge To USD 20380.8 Million By 2028

•

The global market for meat processing equipment is expected to increase at a CAGR of 5.2 percent from…

-

LED Driver Market Is Set for a Rapid Growth and is Expected to Reach USD around 19.03 Billion by 2028

•

The adoption of LED lighting in general lighting applications, rising need for energy-efficient lighting systems, IoT and lighting…

-

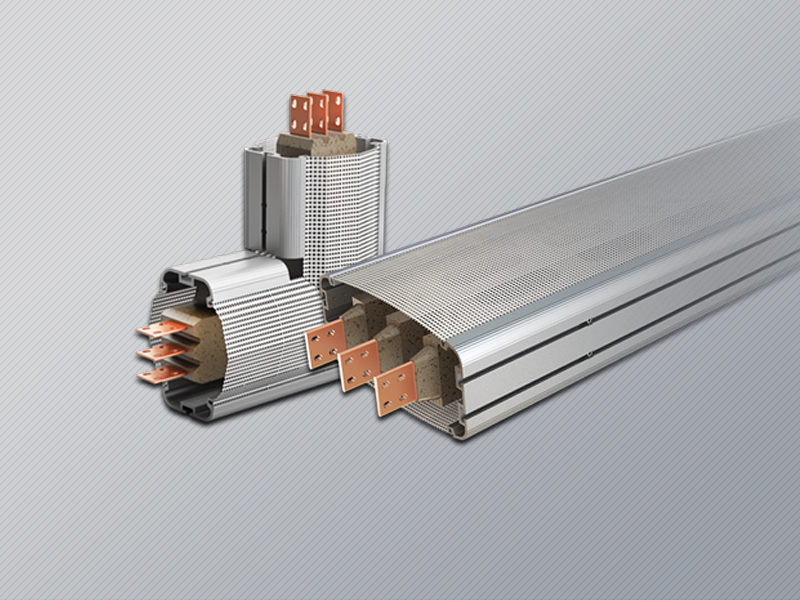

High-Voltage Switchgear Market: Fuel for the Energy and Mobility Revolutions

•

In the High-Voltage Switchgear Market research report, key competitors’ strategic analysis, micro-and macro-market trends, pricing analysis, and a…

Recent Posts

- Global Oral Proteins And Peptides Market Industry Growth Factor, Overview, Demand, and Current Trends with Forecast to 2028

- Global Healthcare IT Outsourcing Market Industrial Report to Cover Process Analysis, Manufacturing Cost Structure 2022-2028

- Revenues from the global digital photography market are expected to rise to USD 149.4 billion by 2028, at a CAGR of 4.4%

Social Media

Advertisement