Author: admin

-

Why Do Truck Drivers Need Critical Illness Insurance?

•

The article explains how industry-wide illness coverage for truckers came about and the actions that were taken to…

-

17 Signs of the Future Asset Management Software

•

Assets are an essential component of any organisation, and their administration, maintenance, and trading all play a key…

-

McDonald’s Agrees To Pay $26 Million To Settle Court Case By Its Employees – Daily News Insights

•

[ad_1] In an attempt to resolve a class-action lawsuit related to wage theft, McDonald’s has agreed to pay…

-

Samsung Will Have Bright Night Camera Sensor Integrated In Galaxy S11 – Daily News Insights

•

[ad_1] Recently, the Dutch website LetsGoDigital has announced that the camera sensors could now be referred to as…

-

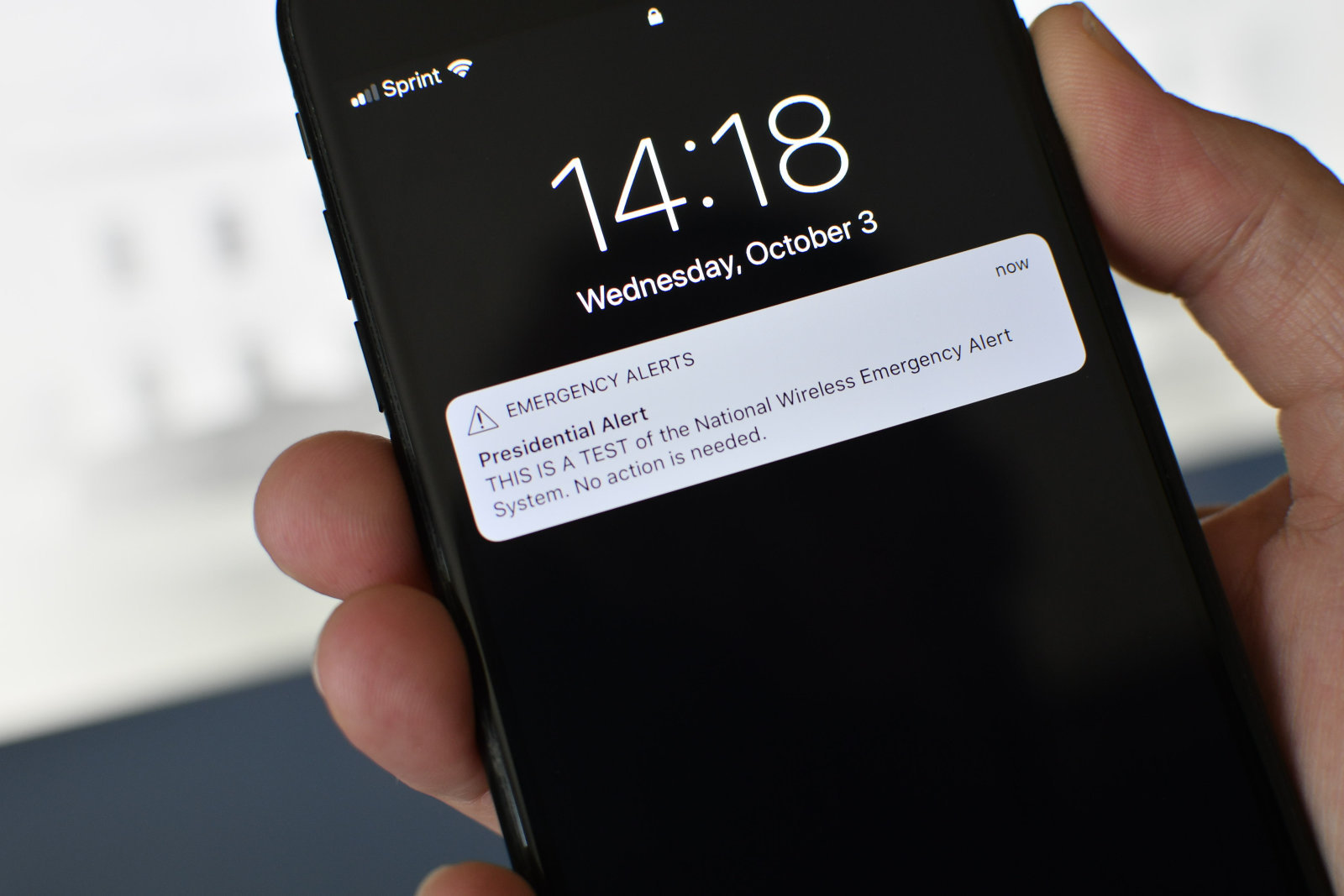

US Wireless Emergency Alerts Are Now Targeted More Locally – Daily News Insights

•

[ad_1] As committed, Wireless Emergency Alerts must now be more refined—and essentially, more applicable. The FCC has declared…

Recent Posts

- Global Oral Proteins And Peptides Market Industry Growth Factor, Overview, Demand, and Current Trends with Forecast to 2028

- Global Healthcare IT Outsourcing Market Industrial Report to Cover Process Analysis, Manufacturing Cost Structure 2022-2028

- Revenues from the global digital photography market are expected to rise to USD 149.4 billion by 2028, at a CAGR of 4.4%

Social Media

Advertisement